DLG aims to strengthen competitiveness after a challenging year

Challenging market conditions, persistently high interest rates, a normalized price level, declining volumes in the Food and Energy business areas, and a slowdown in German economy combined to create a near-perfect storm that impacts the annual results.

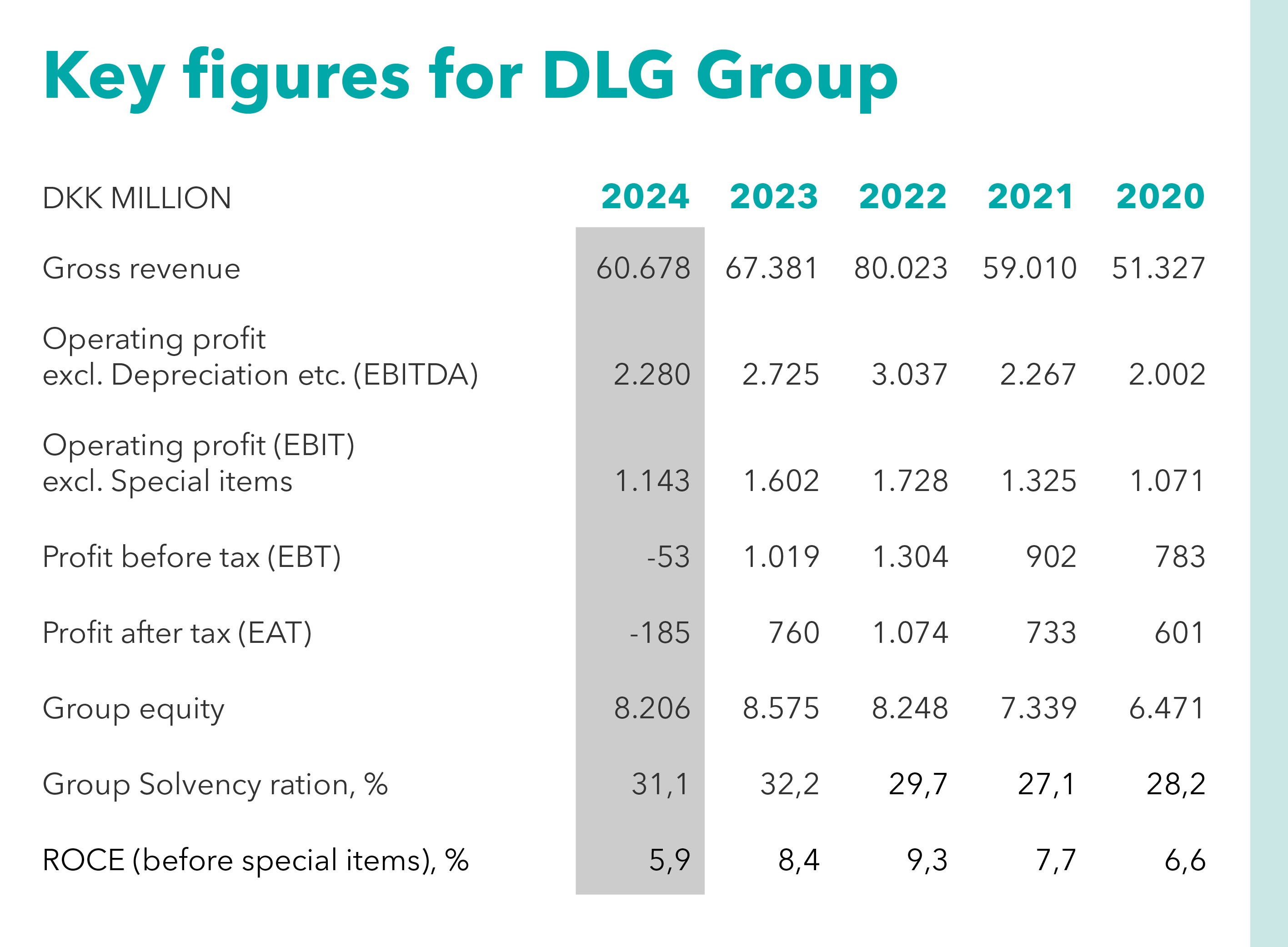

In 2024 the revenue totaled DKK 60.7 billion compared to DKK 67.4 billion in 2023, while EBITDA was DKK 2.3 billion compared to DKK 2.7 billion. Profit before tax amounted to DKK - 53 million, while profit after tax was DKK - 185 million. Overall, DLG Group continues to deliver on its strategic financial commitments with a leverage below 4.5 and Group Solvency ratio exceeding 30 %.

“We must acknowledge that there are several external factors that have challenged our business in 2024. It calls for action and emphasizes that there is an increased need to adapt to the future and strengthen our competitiveness ensuring we remain a strong partner to our owners and customers. We need to place stronger emphasis on our core business, focus on simplification, leverage the synergies within the group, and build an even closer relationship with our owners and customers,” says Group CEO, Peter Giørtz-Carlsen.

DLG Group is also implementing a series of structural adjustments in the business to address the changing market conditions. As a result, the annual results include a number of special items and impairments, which mean that the overall result for the year is negative. As a result of that, there will be no profit declaration distributed to the owners this year. Over the past five years DLG has distributed more than DKK 800 million to its owners.

"As a cooperative, it is far from satisfactory to deliver an annual results, where we do not distribute profit to our owners. However, we have made a conscious decision to make the necessary structural adjustments now, and we are taking the first steps towards ensuring a stronger and more sustainable DLG in the long run. It goes without saying that a stable profit declaration to the owners is an important goal for us," says Peter Giørtz-Carlsen.

Small harvest and declining commodity prices

After a period of price increases driven by extraordinary global demand, price levels are now normalizing across the food and energy business. In 2024 the European harvest yields were close to 10 % below average and EU grain exports decreased by 33 % compared to the previous year, mainly due to declining commodity prices worldwide.

Despite the competitive market, DLG has successfully gained additional market shares in Denmark, and the positive impacts of the transformation within Team Agrar and the Vilofoss Group are now evident in the results. Once again Danæg contributes with strong earnings.

"Our core business rests on a solid foundation. We should reinforce it to fulfill our ambition of becoming our customers' preferred partner, both in their daily operations and in the green transition," says Peter Giørtz-Carlsen.

Fragile German economy affects demand

The slowdown in the German economy is affecting the energy and builders’ merchant divisions, with continuing declining demand throughout 2024. Within the German construction industry, the lower activity levels are particularly evident in the construction of single-family houses and apartments, where the number of issued building permits fell by 22% and 19% respectively. Yet, DLG Group's builders’ merchant division continues to deliver satisfactory margins in a highly competitive market.

"Of course, we would welcome a boost in the German economy, but first and foremost, we must take responsibility to strengthen our competitiveness and ensure future growth in Germany, which will remain a key market for us,” says Peter Giørtz-Carlsen.

Accelerating the transition towards the DLG Group of the future

It is a strategic priority for DLG Group to deliver key contributions to the green transition. In 2024, DLG formed a strategic partnership with Novo Holdings to enhance plant breeding efforts, made a substantial investment in Argentina to secure import of segregated deforestation-free soy for the Northern European market, and important commercial steps were taken to advance the market for regenerative agriculture. To create value in the green transition, DLG's focus in this area must be even more closely aligned with the core business going forward.

"We need to strike the right balance where our core business and the contribution to the green transition go hand in hand. In recent years, we have invested in projects that have proven difficult to scale and get into profitable operation. In the future, we will invest in projects that are more closely aligned with our core business, where there is greater potential for scaling and commercialization,” says Peter Giørtz-Carlsen.

Outlook for 2025

Geopolitical unrest, trade barriers and continued high interest rates is expected to continue in 2025 and are likely to keep affecting market conditions. In the short term, the German economy is not expected to improve significantly, and the structural development in agriculture continues, presenting new demands for the group.

"We have initiated the necessary adjustments to build a stronger and more competitive business. Therefore, we expect more stable earnings, but we are also very aware that external factors can continue to influence our results," says Peter Giørtz-Carlsen.